Updated for 2025 • Hardware, mobile, smart-contract and multisig wallets explained • Affiliate links included where applicable

Best Crypto Wallets 2025: Top Secure Picks

As crypto ecosystems diversify, wallet choices have expanded beyond simple hardware vs software. In 2025, secure custody options include classic hardware devices, air-gapped card wallets, smart-contract multisig vaults, and mobile wallets that support account abstraction. This guide explains the tradeoffs, recommends best-in-class products for common use cases, and links to setup and tax resources across TheTechInfluencer network.

Why wallet choice matters in 2025

Cryptocurrencies are bearer assets controlled by private keys. Who holds or generates those keys defines custody and risk. Wallet selection affects security, recovery, interoperability, tax reporting, and DeFi access. TheTechInfluencer recommends combining custody strategies: cold storage for long-term holdings, multisig for pooled funds, and a secure hot wallet for daily interactions. See our beginner’s crypto guide for foundational steps and tax export workflows if you trade frequently.

Top-rated hardware wallets (cold storage)

Note: Hardware wallet model availability and new firmware releases affect behaviour. Always buy hardware wallets from official vendors or verified resellers to avoid supply-chain tampering. For more on wallet security practices see crypto tax and custody considerations and our crypto starter guide.

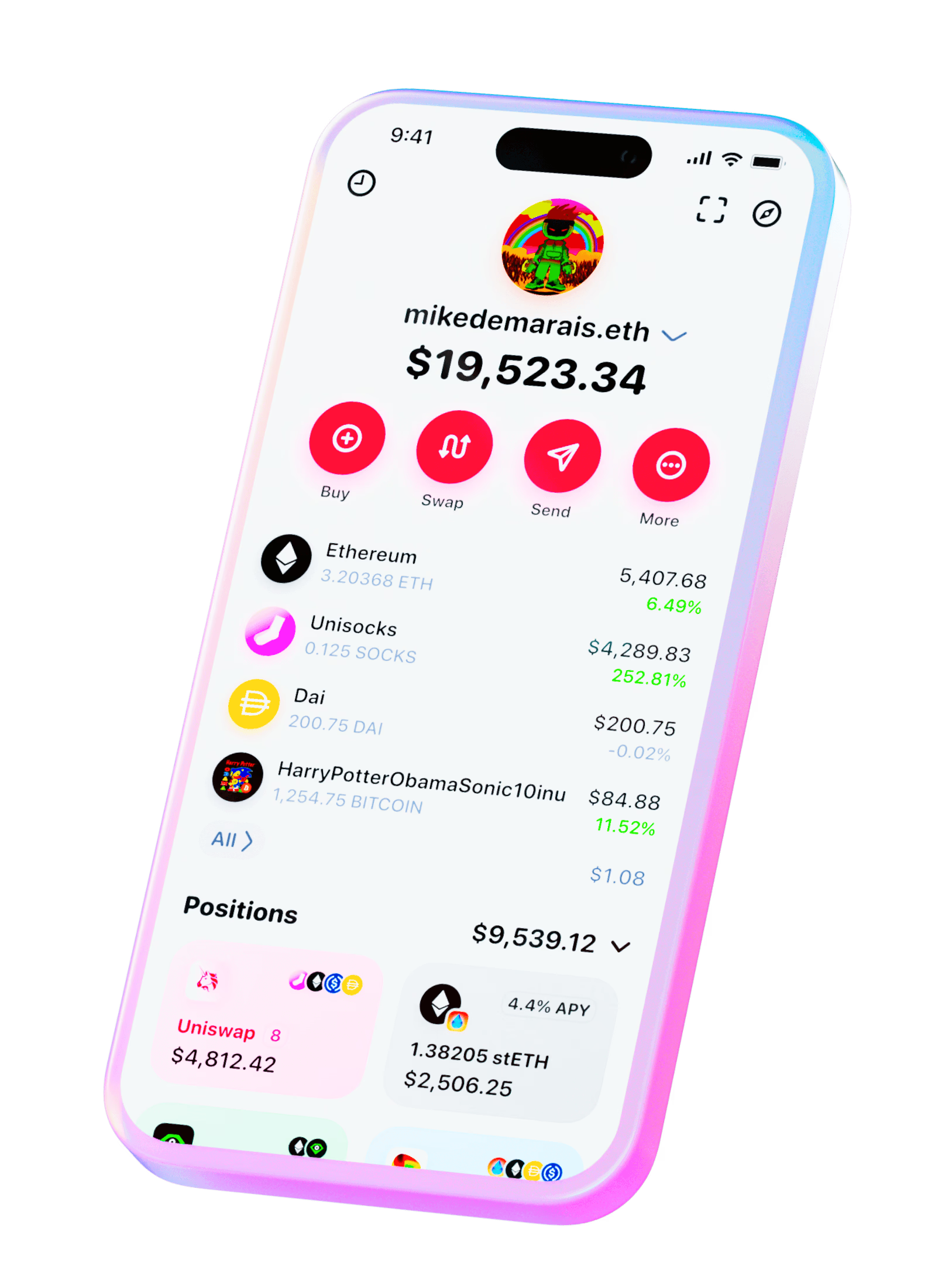

Best hot, mobile and browser wallets

Hot wallets are convenient but exposed. For larger sums, combine a hot wallet plus a hardware wallet or multisig vault. See our deep dive on wallet security and best-practices in the cluster and check tax export guidance if you plan to trade often.

Smart-contract wallets and multisig vaults

Account abstraction and multisig solutions matured into production-ready custody alternatives. Multi-signature vaults reduce single-actor risk, and smart-contract wallets allow social recovery and daily limits. These are increasingly standard for teams, DAOs or households that share assets.

| Use case | Recommended | Why |

|---|---|---|

| Shared custody for teams | Gnosis Safe | Proven multisig UX, broad integrations, on-chain events |

| Social recovery for individuals | Argent / smart-contract wallets | Recovery via trusted guardians, no seed phrase trauma |

| Institutional custody with self-custody controls | CuStody + multisig + hardware signing | Combines hardware wallet keys with policy enforcement |

Multisig vaults are ideal for treasury, DAO, or family funds. For step-by-step multisig setup and signing flows, link to the technology primer and plan recovery methods that match your threat model.

How to choose the right wallet

Selection depends on four factors: security need, chain support, convenience, and recovery strategy.

- Security need: large long-term holdings belong in air-gapped hardware or multisig vaults.

- Chain support: choose wallets that support the chains your tokens live on — cross-chain bridges add complexity and risk.

- Convenience: mobile and browser wallets are best for daily activity but should only hold small sums.

- Recovery: test your backup and recovery approach before first deposit. Prefer multiple geographically separated backups and consider metal seed backups for resilience.

Recommended setups

- Beginner: Coinbase Wallet for small holdings + one hardware for savings

- Trader: Ledger Nano X + MetaMask for trading + dedicated tax export workflow

- DAO / shared treasury: Gnosis Safe + hardware signer for each key

FAQ & Security checklist

Quick security checklist

- Buy hardware wallets from official stores or verified sellers

- Never share seed phrases or private keys with anyone

- Use hardware signing for high value transactions and verify addresses on-device

- Keep at least two secure backups of recovery seeds (one off-site)

- Use multi-factor authentication and guard your email accounts tied to wallet services

- For DeFi approvals, use spend-limits, revoke approvals regularly and use a fresh wallet for high-risk interactions

Common questions

Is a hardware wallet enough?

Hardware wallets protect keys but are one piece of a security model. Users need secure backups, careful device procurement, and safe signing habits to be truly secure. Multisig further reduces single-point failures.

What about custodial exchanges?

Custodial exchanges offer convenience and services like staking, but they hold private keys and therefore create counterparty risk. Use exchanges for trades and non-custodial wallets for savings. See our article on crypto tax laws for transfer and reporting implications.

Further reading and links

- How to Get Started in Cryptocurrency — beginner guide

- Exporting transactions for tax reporting

- Blockchain vs Hashgraph — background on chains and how wallets interact with ledgers

- Bitcoin.org — choose your wallet — high-level comparison

- Ethereum.org — wallets — official chain wallet listings

- r/Bitcoin — community discussion — community experiences and troubleshooting